Valuation and Story #26

Been Working On Copyright Valuation…

Trying to figure out a way to explain it. But so many elements to it, it makes it tough.

But writers believe, especially indie writers, that their work has no value.

Yet every time you license a book or story to say, Amazon, and they license it to a customer, you are making money from the value of your work.

You license a copy from your own store to a reader, you are making money from the value of your work. Same with doing a Kickstarter campaign. And on and on and on…

Copyright is property. So is trademark.

So every time you create a story, you create property that has value.

So today I figured I would try to explain it this way. Say your inventory consists of 200 published stories and collections and novels.

Each is equal to owning a condo in a two hundred unit condo complex. (Yes, I know the difference between real and IP, just go with me.)

You own all two hundred condos in the building. You can lease them out (say to Amazon or Asimov’s Magazine or a Kickstarter project or your own store), or just let them sit empty. Your choice. But the building itself has value as does each unit.

So an analogy to help in perspective.

But for this analogy ignore derivative rights, because they make your condo building a science fiction place of alternate growth and multiple dimensions.

And ignore the fact that the valuation of a single novel might be far, far more than the valuation of a penthouse condo in a major city because of the 70 year aspect.

But if you realize you are creating property every time you finish a story or novel and that the property has value, no matter how you imagine that value, you will be ahead of the game.

STORY #26

Too much football and walking to lunch and grocery shopping, plus two short naps. A bunch of email and some work on Pulphouse editing and damned lucky I even got to a story. But I did, saw the phrase “Ghost Ship” and instantly went to writing a Seeders Universe story. Playing with size. I might change the title.

And today I realized that story #14 as I spell checked it to get it ready to give to Kris was a novel start and not a short story. My wrap on the end flat did not work and I love the idea, so going to leave it go to the novel start pile. (It’s a Mary Jo Assassin novel start.) So that is two novel starts out of 26 stories so far. Not bad at all.

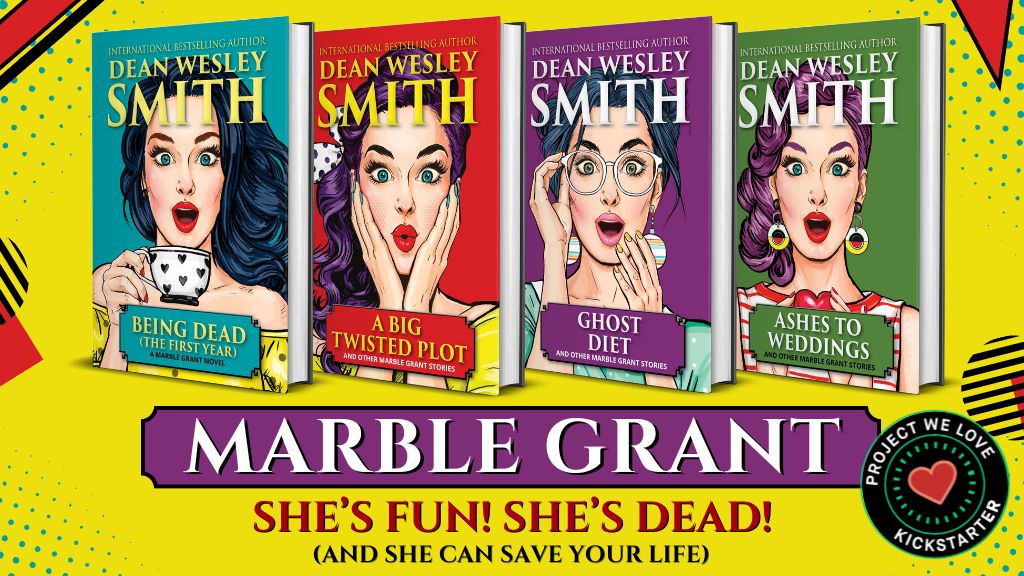

I will give a rundown of everything at the end of the month, titles, series, word counts, and other details. I think I have done 4 Marble Grant stories so far. Marble and her beautiful partner and lover Sims are on my mind since on February 4th firing up a Marble Grant Kickstarter.

Here is the link to it. Marble Grant Kickstarter

Take a look at the promotions page if you get a chance. Again it starts on the 4th. Going to be great fun.

5 Comments

James Palmer

Great thoughts on IP valuation, Dean. My issue comes from how much to value it. It’s value is only what someone is willing to pay for it. If I sell a story to F&SF for $230, the value is $230, at least until I sell it again as a reprint. If I put it out there myself and no one buys it, it’s value is essentially zero from as best as I’m able to tell.

There’s also the issue of overvaluing IP, which happens all the time. I’ve shared the story before about Lorraine Williams and the Buck Rogers IP she owns that no one else wants or cares about except for her. She got $5 million less for the sale of TSR because she didn’t want to give up an IP the buyer didn’t even want.

Is there a way to realistically value our IP so we not only give too much of it away but also don’t lose out on some amount of steady, decent money because we think it’s worth a whole lot more when it really isn’t?

dwsmith

James, afraid you are so wrong on the value of that story being $230 and only what someone would pay for it.I think you gave me a sudden understanding of what I am walking up against with writers understanding value.

See, if I thought the way you are, and believed my little vampire story was only worth a few hundred bucks that I got from selling it to F&SF, I would have missed out on over $20,000 and still growing of actual cash out of that IP and a hundreds of thousands in valuation over the life of that IP (My life plus 70 years.)

Your way of thinking is that you bought way back a stock in Apple for $15 and that is what you think it is worth. Or you bought a house in 1970 in LA for $50,000 and that is what you think it is worth.

I will do some blogs in the next few days about how to find and roughly calculate for yourself a valuation. Places courts use to value copyright in cases. There are still numbers of different ways.

Traditional publishing buys some poor writers book for $10,000 for all rights. Maybe publishes it, sells 70 copies.

The book is valued on the corporation spread sheet at $200,000 conservatively. They start a 20 year depreciation schedule on it (for ease of math) taking a tax break of $10,000 a year on that book. At the end of 20 years, because IP has special rules, they can continue to take the same amount per year tax break for the life of the copyright (author’s death plus 70). So that little dead book some poor author sold for all rights can make the company almost a million in tax breaks over its life.

Ever wonder why the big four publishers are owned by major international conglomerates?

David

But isn’t there a difference between a company publishing a story and an individual publishing the same story in terms of their tax treatment?

If I’m a company, I don’t have to pay income tax. I only pay tax on my profits, which is the difference between my revenue and my operating expenses. If I can artificially manipulate my operating expense to be larger than my revenue, I can claim a tax break. Hence the international conglomerates who get to claim their operating expenses against their revenue and fail to pay tax on their income.

But if I’m an individual, then I can’t do that. I get taxed on my income (my revenue) My operating expenses aren’t taken into account. I have to pay my operating expenses out of my income. Okay, I can claim some tax deductions on a limited amount of business (operating) expenses. It’s worth something, but not a lot. But if I went to my tax authority and claimed that the 20,000 word novella I’ve just written is worth $200,000 and I want a reduction in my income tax against it for the next 20 years, then they’d just laugh at me.

So, if I’m publishing my own stories, the value of the IP is only relevant if I want to sell it to someone else. For me, the IP has no value. It’s an income tax liability. For someone else it’s a tax write-off. As was a recent Bat film.

I’m not quite sure where I’ve got to with this post or the thought that is behind it. But I’m fairly certain that an individual author isn’t allowed to get away with the shenanigans of a company accounting system.

dwsmith

David, you are right on some stuff, but so wrong on other stuff. Yes, you must be a corporation, and set up to depreciate assets (certain type of accounting) to do depreciation. Easy for you to do. But you must have an accountant help you.

You are flat wrong about personal income (unless you are in some country I do not know their tax code.)

Here in the States, you simply file a Schedule C form to show your writing income and your expenses. just standard. You don’t need to be a corporation until your writing income causes you to write a check to a government. Then become a corporation.

Yes, if you tried to depreciate a copyright without it being the correct accounting in a corporation, they would laugh. Can’t do that.

Your problem is that you don’t think that individual authors can be corporations. Oops, of course they can. For the longest time (2 plus decades) all my writing income came into Bryant Street Incorporated. Kris into White Mist Mountain Incorporated. Those corporations are now dissolved as we have moved on to a different corporation structure. But I have been a corporation with my writing since 1992.

Kate Pavelle

I love the Marble Grant covers! As for valuation, I see derivative rights as contractual privileges attached to each suite. Some are commercial and pay fot that. Some have pet agreements for their tiger, some double as public performance spaces (essentially, enter your landlord’s nightmare-how much would you charge?)

Also, I see series as separate buildings, ymmv.

I like the multiple dimensions concept better, because it allows for slicing the pie and derivative right can exist concurrently, wheras an office suite is more grounded to physical limitations.